How Professionals Can Earn More with Project Report Services

The financial environment in India is quickly evolving and so has the high demand for project report services. SIDBI reported that in FY 2023, bank loans were almost at 17.5 lakh crore in India to the MSMEs. Interestingly, statistics indicate that 70 percent of loans that have thorough project reports are approved as opposed to only 40 percent that lack it. Such a gap [...]

How to Apply for an IDFC First Bank Business Loan Online

Are you a small business owner in need of easy and fast money? IDFC first bank business loan has an easy online application process that is simple, quick, and less paperwork, and flexible repayments. This loan can help you make progress whether you are looking to grow your business, maintain a working capital or invest in new machinery. We will guide you through the [...]

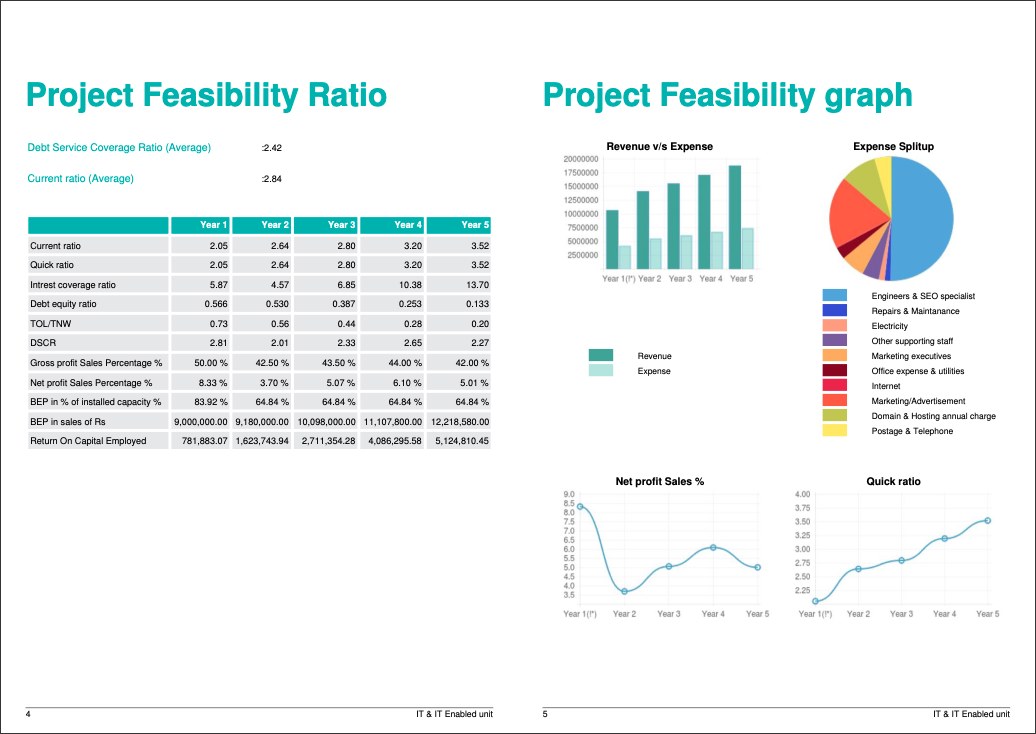

Best Format for Project Report for Bank Loan

A project report for bank loan is one of the most important documents you will require in case you need a bank loan to start a business. It assists the banks in knowing your business model, the financial plan and the repayment capacity. However, getting one ready may seem daunting, particularly when you do not know how to start or what the project report [...]

Chief Minister’s Startup Scheme(CMSS) Sikkim

The Government approved the Chief Minister's Startup Scheme(CMSS) Sikkim on August 15, 2017, to encourage local unemployed youth. College graduates establish new entrepreneurial projects and self-employment possibilities in rural and urban areas of Sikkim. The Sikkim Startup India scheme plans to start businesses in the industrial and service sectors, such as farming, horticulture, food processing, animal husbandry, handloom, handicrafts, and so on. Also, for [...]

How to Apply for Karma Sathi Prakalpa Scheme in West Bengal

The West Bengal government introduced the Karma Sathi Prakalpa scheme to help the dreams of young entrepreneurs. This project offers simple funding up to 2 lakh rupees to get the youth to begin their own business. Since it was launched in 2020, more than 1 lakh beneficiaries have availed of the scheme so far. We will guide you through all the information you have [...]

Chief Minister’s Rojgar Yojana (CMRY), Goa

The State Government of Goa has started the Chief Minister's Rojgar Yojana (CMRY). Collaboration with the Economic Development Corporation of Goa for unemployed youth. Under this scheme, with the help of government loans, other backward class people, scheduled castes, scheduled tribes and all ordinary people have to provide employment. Under the CMRY scheme, the government provides 30 days of compulsory entrepreneurship training before disbursement [...]