Business Loans for Manufacturers in India

India is the fifth largest manufacturing country. This sector has been growing at an average of 7%-8% annually. As a developing country, there is a huge opportunity for manufacturers to use the increasing demand, both locally as well as [...]

How to Apply for Karma Sathi Prakalpa Scheme in West Bengal

The West Bengal government introduced the Karma Sathi Prakalpa scheme to help the dreams of young entrepreneurs. This project offers simple funding up to 2 lakh rupees to get the youth to begin their own business. Since it was [...]

How to Access Global Markets with Low Investment?

“95% of the world’s consumers live outside your domestic market.” – World Bank This single statistic shows why businesses of all sizes, from small exporters to fast-growing startups, are increasingly looking outward. Until recently, the idea of expanding globally [...]

What is the difference between liability and debt?

Debt majorly refers to the money you borrowed, but liabilities are your financial responsibilities. At times debt can represent liability, but not all debt is a liability. Liability vs Debt is a vital part of any business that wants [...]

How to Improve CIBIL Score

If you have a low CIBIL score, then don’t think it’s the end of all loans, you can improve the score and go for credit. You can improve the CIBIL score by following the given steps & it takes [...]

Point of Sale (POS) System

The Point of Sale (POS) System serves as the central element of your business. A POS is a location where your customer makes a payment for products or services at your shop. Simply put, it’s the centre where everything [...]

Flexible Side Jobs for Moms: Balancing Family and Finances

In the era of digital technology, a lot of moms are seeking a solution to earn money at home without interfering with family time. And that is where side jobs for moms come in! You are a homemaker, new [...]

Understanding the Top 10 Financial Ratios for Smart Investing

Did you know that more than 90 percent of successful investors apply financial ratios to gauge the performance of a company in making investment decisions? This is a testimony to the importance of knowing the figures that a business [...]

5 BEST SMALL INVESTMENT BUSINESS IDEAS IN INDIA

The following are the 5 best small investment business ideas: Travel Agency It means an agency engaged in selling and arranging transportation, accommodations, tours, and trips for travellers. In addition to booking reservations, they assist customers in choosing their [...]

Types of Working Capital Loan

There are different types of working capital financing available in the Indian market. As a result, applicants can choose from Cash credit/Bank overdraft, trade credit, bank guarantee, invoice factoring, and letter of credit. Inadequate working capital can also result [...]

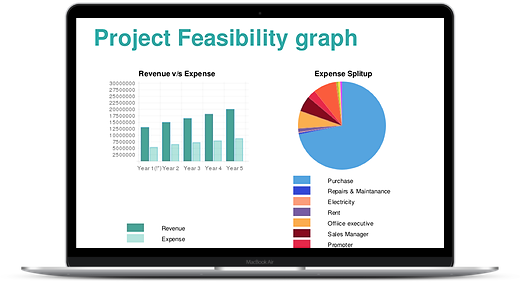

Project Report for Bank Loan

If you need a bank loan to start your dream business, a project report is a necessary document. Struggling to make one? Don’t worry, you are at the right place! In this blog, we will discuss about: 1) What [...]

How to Apply for a Loan Against Inventory – A Step-by-Step Guide

Did you know that almost 65% of the small and medium businesses in India have problems with the working capital because of the stock holding? The inventory in your warehouse can literally open up instant cash via loan against [...]

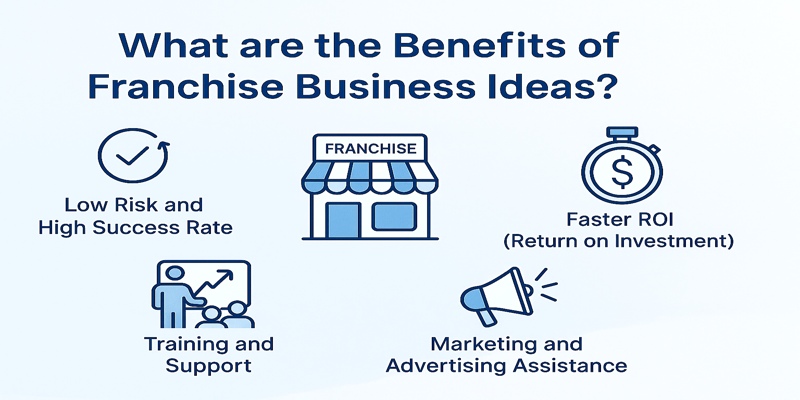

Maximize Your Investment with Top Franchise Business Ideas in India

Have you ever had a dream to start your own business and not reinvent the wheel? Franchise business ideas in India are making that dream a reality to thousands of people who want to become entrepreneurs. India has become [...]

Tax Saving Tips for Entrepreneurs

Entrepreneurs and business owners are accountable for paying income tax on the revenues generated. Every entrepreneur or business owner must accept the hard reality that they pay a portion of their revenue to the government as tax. This can [...]

MSME Loan schemes available in Rajasthan

Small and Medium Enterprises (SMEs) play a vital role in the economic development of Rajasthan. With the growth of the MSME sector, there has been a significant increase in the demand for financial assistance. To cater to this need, [...]

NBFC DSA Registration in India: Eligibility, Documents & Process

Confusing how to become a Direct Selling Agent (DSA) of loans in India? NBFC DSA registration will help you to enter a highly rewarding career in financial services. By registering with NBFC DSA online, individuals and small business owners [...]

Top 10 Low Investment Business Ideas in India

Party planning or event management Good event management requires business management and leadership skills, as well as a lot of imagination. Parties, ceremonies, honours and felicitations, exhibits, seminars, radio, TV or reality shows, festivals, and other events could all [...]

Mukhyamantri Yuva Swarozgar Yojana, U.P

It is accurate to say that the employment rate cannot keep up with the population's exponential growth. There is a sizable population of educated but jobless youth. Some are aspirational and strongly desire to launch their own company. The [...]

Priority to MSMEs in Post-COVID

According to the Annual Report of the Department of MSME published in September 2019, there are 6.34 crore MSMEs in India. The COVID pandemic has left an enduring impact on the economy. Global supply chains are affected, imports and [...]

How Does Financial Accounting Help Business Management?

Accounting is necessary for small business owners as it helps the owners, managers, investors, and other stakeholders in the business judge the performance of the business. Even the smallest business has more accounting data. Financial accounting helps business management [...]

Types of Financial Statements

Financial statements are written records that convey the business activities and the financial performance of a company. Government agencies, accountants, firms, etc., often audit these to ensure accuracy and for tax, financing, or investing purposes. Financial statements include: Balance [...]

What is Mukhyamantri Yuva Udyami Loan? Eligibility, Benefits & Application Guide

When you want to start off your own business, it can be a big move, more so when there is little money involved. The government has introduced the Mukhyamantri Yuva Udyami Loan scheme to provide financial support to young [...]

Aatmanirbhar Bharath Abhiyan

In his fifth address to the nation, Prime Minister Narendra Modi launched Atma-Nirbhar Bharat Abhiyan(ABA). The objective of this ‘Self-Reliant India Mission’ is to bring a special economic package that will offer relief measures across all the sectors in [...]

FSSAI – Registration/License

FSSAI stands for Food Safety and Standards Authority of India which is an organization that monitors and governs the food business in India. It is an autonomous body that is established under the Ministry of Health & Family Welfare, [...]

How to Get Government Loan for Beauty Parlour Business in India

Do you have a dream to own your own beauty parlour but have concerns over how to finance it? The best thing is--you do not necessarily have to scramble. Government loan for beauty parlour business in India is designed [...]