Business Loan for Grocery Stores – Eligibility & Documents Required

Did you know that 90% of India's retail sector is unorganised and consists of small grocery/kirana stores. As per the latest survey, there are around 12 million grocery stores across India. Most of these shops face regular cash flow [...]

Business Loan EMI Calculation

Business loans are loans that companies avail themselves of with a specific interest and repayment period to meet the growing business requirement. Business loans help to fund the business to expand existing business, production, buy new machinery, etc. Funding [...]

How to Pitch Your Business to Your Community, Friends and Family

Someone who is starting or continuing a business knows the importance of pitching. Sometimes, pitching to friends and family can be more complicated than pitching to strangers. Friends and family should be seen as one of your primary investment [...]

MSME Loan schemes available in Delhi

Delhi, being the capital of India, has a substantial number of MSMEs. To support the growth and development of this sector, both the central and state governments have launched various loan schemes. In this article, we will discuss some [...]

PNB Business Loan

Punjab National Bank (PNB), provides business loans to startups, entrepreneurs, as well as self-employed professionals. They intend to support the business capital requirements or to expand business operations. The business loan interest rate given by PNB depends on the [...]

Earn Money Sharing Links: From WhatsApp to Wallet in Simple Steps

Did you realize that you can even use your WhatsApp chat to make money? Yes, you can earn money sharing links and turn your free time into a constant income with the right approach. Thousands of individuals are already [...]

HDFC Bank Business Loan

HDFC Bank promotes business loans to develop your own business anywhere in India, be it large-scale ventures or small-scale firms. These schemes are made for people requiring funds to operate the business. Also, these are free of collateral. Its [...]

What Is an Expense Report?

One uses an Expense Report form to record business expenses. The employees report various business expenses incurred by them out of their pockets. It includes any purchases that are necessary to run a business, such as parking, meals, gas, [...]

What are PSB Loans in 59 minutes?

The Government of India launched a quick business loan portal for individuals who wish to extend their existing business. Under this scheme, MSMEs can get loan amounts from Rs. 1 Lakh to Rs. 5 Crore in less than 59 minutes [...]

Axis Bank Business Loan

Axis Bank has come up with a quick business loan that can boost your business growth. Through this loan, they offer competitive interest rates, flexible repayment terms and an easy application process. Axis Bank business loan is a great [...]

Madhyapradesh Mukhya Mantri Swarozgar Yojna

Madhyapradesh Mukhya Mantri Swarozgar Yojna is a scheme that offers loans up to 25 lakhs for promoting entrepreneurship in Madhya Pradesh without the need for collateral security. Who is eligible for this scheme? Applicant must be a permanent resident [...]

What are the Documents Required for Mudra Loan?

PMMY loan offers up to Rs. 10 Lakh for MSMEs for non-corporate non-farming origin businesses. The objective is to encourage the young generation into entrepreneurship by promoting them with financial aid, focusing on the growth of micro-enterprises. The applicant [...]

Business Loan Eligibility

Bank provides business loans to a wide variety of small, medium, and large enterprises, and professionals. Also, provide top-up facilities for existing business loan customers who may require more credit at a later period. To meet the business loan [...]

Business Loans for Manufacturers in India

India is the fifth largest manufacturing country. This sector has been growing at an average of 7%-8% annually. As a developing country, there is a huge opportunity for manufacturers to use the increasing demand, both locally as well as [...]

Andhra Bank Business Loan

Many people will have the dream of starting their own business or if one already has a business to expand it and build it into something better. MSMEs or MNCs everyone will require funds at one point in time [...]

Top 10 Most Successful Small Business Ideas to Start with Low Investment

Did you know that more than 70 percent of Indian start-ups are initiated with an initial investment of less than 5 lakhs- this is a testimony that big success does not necessarily require big capital. With the current world, [...]

How Loan Agents Can Grow Their Income with Project Report Services

Did you realize that almost 70% of bank loan applications are postponed or denied because of incomplete project reports or improperly prepared project reports? This is a potential opportunity to be exploited by you, as a loan agent. You [...]

What is Current Ratio?

The current ratio is a liquidity ratio that calculates a company's ability to meet its short-term debt and obligations, or those due in a single year, using balance-sheet assets. The working capital ratio is another name for it. Investors [...]

CGTMSE Loan: How to Get Collateral-Free Business Loans in India

Did you realise that since its introduction more than 45 lakh small businesses in India have been beneficiaries of the CGTMSE Loan Scheme? To most entrepreneurs, it seems almost impossible to access a business loan without collateral, and that [...]

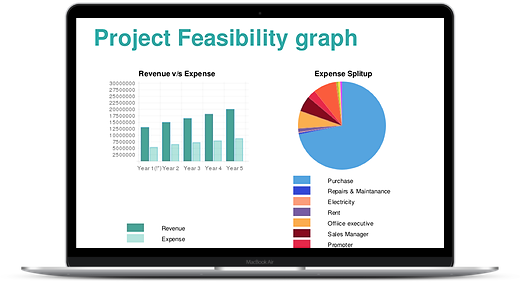

Project Report for Bank Loan

If you need a bank loan to start your dream business, a project report is a necessary document. Struggling to make one? Don’t worry, you are at the right place! In this blog, we will discuss about: 1) What [...]

Mudra Loan Online Apply: Step-by-Step Process for First-Time Applicants

Are you considering applying for a Mudra loan online and not sure where to start? No worries, I will guide you how to do it step by step. Whether you're a small business owner, a startup founder, or simply [...]

Kudumbashree Micro Enterprise Development

On August 27, 2020, Chief Minister Pinarayi Vijayan declared the Kerala Athijeevanam Keraleeyam Scheme. The state government will utilize its CM Local Employment Assurance Programme (LEAP) to execute this scheme. Kudumbashree Micro Enterprise development programme is proposing to introduce [...]

Most Popular Loan Schemes in India in 2023

The following are some most popular loan schemes that you can avail in India: 1. PMEGP (Prime Minister's Employment Generation Programme ) Who is eligible for PMEGP? Any individual above the age of 18 can apply for the scheme. [...]

Unlocking Success: The ABCs of Project Report Formats

In the realm of business, the project report is the beacon that illuminates the path to success. However, crafting an effective project report goes beyond the content—it extends to the format. The choice between various project report formats, including Word [...]

Udyam Registration in India

A micro, small and medium enterprise (MSME) will now be identified as Udyam as per the notification issued by the Ministry of MSME on 26 June 2020. The ministry has also come up with specific guidelines for the classification of MSMEs. Also procedure [...]