PMEGP Loan Process Step by Step: How to Apply and Get Approved

Considering starting a business of your own but afraid of financing? The answer could be the PMEGP loan. The Prime Minister Employment Generation Programme (PMEGP) is an initiative of the Government of India which provides financial support and subsidies to first-time entrepreneurs to convert their ideas into reality. This blog will take you through the steps of the PMEGP loan process starting with how [...]

How to Prepare a Mudra Loan Project Report Step-by-Step

Want to open a business using Mudra loan? The first and most important step is to develop a well-structured project report for mudra loan. This mudra loan project report will inform the bank all it wants to know about your business idea-what you are going to do, how much funds you require and how you will utilize it and how you will pay the [...]

What Is Capital Budgeting? Methods, Importance & Examples Explained

Growth is desired by every business, however, the most important thing is to make the right investment decision. That’s why capital budgeting comes up here. It assists businesses to determine the best places to invest their funds in order to get maximum returns. Capital budgeting is applied in long-term investment such as purchasing equipment, initiating a new project, or entering new markets. A Deloitte [...]

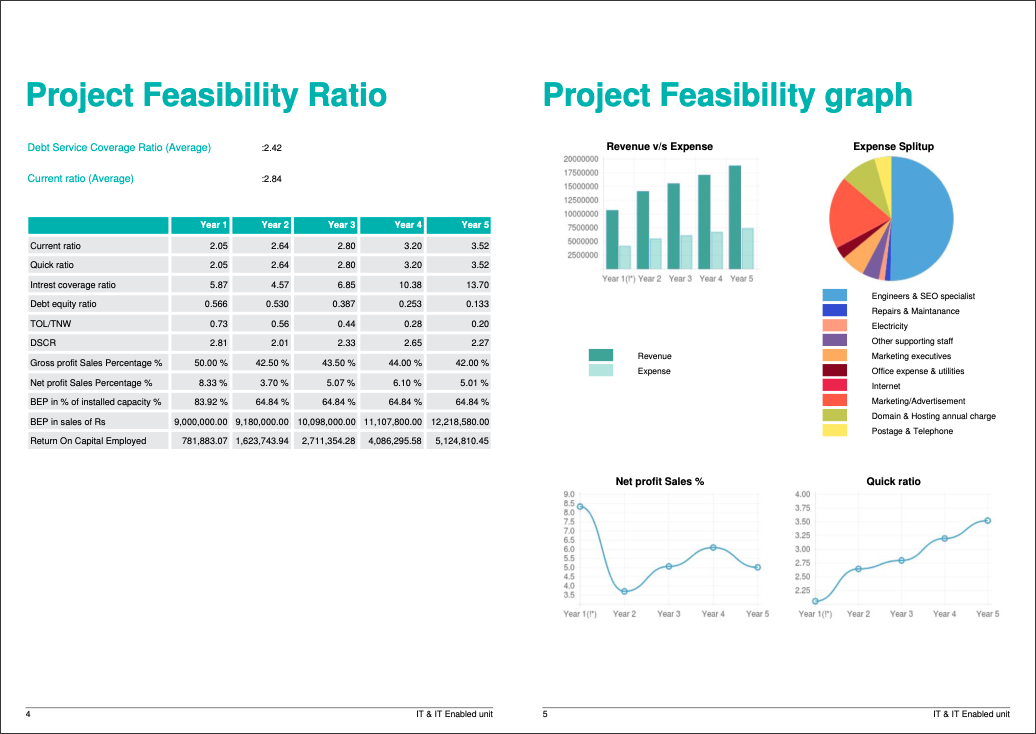

Best Format for Project Report for Bank Loan Application

A project report for bank loan is one of the most important documents you will require in case you need a bank loan to start a business. It assists the banks in knowing your business model, the financial plan and the repayment capacity. However, getting one ready may seem daunting, particularly when you do not know how to start or what the project report [...]

Top 10 Most Popular Types of Loans in India

Are you planning to buy a house, start a business, or fund your child’s education? No matter your goal, there's likely a loan designed just for it. Understanding the different types of loans in India is the first step to making a smart financial decision. From personal loans to home loans, and education to business financing, India offers a wide range of lending options [...]

Government-Backed MSME Loan Schemes in Kerala You Should Know

Have you ever thought how small businesses in Kerala can still grow with a tight budget and limited resources? This can be found in the MSME Loan Schemes in Kerala which are able to provide the much needed financial boost to many entrepreneurs. Such schemes are aimed at simplifying the process of funding, quickening and opening up access to micro, small, and medium businesses. [...]